Spring and early summer are the busiest time of the year for real estate closings — we write homeowners insurance. Let us walk you through some do’s and don’ts in that process.

CHOOSE THE RIGHT COVERAGE VALUATION METHOD FOR YOUR HOME AND MAKE SURE YOUR COVERAGE LIMIT IS SUFFICIENT

Reinstatement Value Clause (RVC), defines the terms and conditions of payment under a property insurance policy. It defines the value that will be payable after a loss, and the conditions under which this value may be altered even after the claim has been accepted by the insurer.

The agreed amount clause is a property insurance provision through which the insurer agrees to waive the coinsurance requirement. Insurers will require a statement of property value ahead of time, signed by the policyholder, as a condition for activating or including an agreed value provision in their policy.

Indemnity Value (IV) is another optional way your insurance company will determine what to pay out on property insurance claims. IV coverage uses the value of the property at the time of the loss. Payment of the indemnity value is designed to put you back in the same financial position you were immediately before the loss occurred.

The coinsurance clause is a provision in all home insurance policies that requires you to carry a certain minimum coverage amount, a percentage of your home’s replacement value. Failure to meet the requirement can significantly reduce your payout after a loss. Insurance carriers know that most losses are partial losses, yet they require coverage be maintained to 80% or above of replacement cost. This is an important actuarial principle of insurance and one that soundly grounds and protects carrier solvency. If a policyholder intentionally or unintentionally carries a coverage limit below the policy coinsurance percent requirement they are in essence usurping the principles of insurance to their own benefit. The coinsurance clause exists to eliminate the potential of that happening and, more importantly, to establish the enforcement penalty when it does.

A replacement cost clause is a clause in an insurance contract that states that the replacement value of an item will be paid in the event of a loss. Replacement value is importantly different from actual cash value.

Actual cash value (ACV) is an amount equal to replacement cost minus the depreciation factor (depending on the property or items age and condition) of the damaged or stolen property at the time of the loss. The actual value for which the property could be bought or sold at the time of loss.

Coverage for contents: At the time you purchase a home insurance policy, it is important to determine the correct value of the content items to be insured. There is no point in insuring the 10-year old gas stove of your grandmother on a depreciated value, or ACV basis even if it is in good working condition. Contents should always be insured for Replacement Cost. Start by making an inventory of items which you want to insure. Take photos of expensive items and put them aside for safe keeping. Insurers will often ask you for assistance in documenting expensive items after a loss and photographs are a great way to prove not only their existence but their condition too. Plus the easier you make the claim for the company to resolve the easier and quicker it gets resolved. Often times insurers will rely on their policyholder to document and even determine the value of personal property items themselves after a loss so a list or inventory is a great idea.

- USE A REPUTABLE INSURANCE AGENT AND DEVELOP A LONG-TERM RELATIONSHIP WITH THEM. THEY WILL BE THE BEST FRIEND YOU COULD EVER HAVE IF THE WORST THING IMAGINABLE EVER HAPPENS.

Rates are important of course but do not choose an insurer based solely on that single criteria. Know the difference between a sales and marketing organization whose product just happens to be insurance and a Professional Independent Insurance Agency. One works primarily trying to get new customers in the door and the other is completely dedicated to keeping them there. The Independent Agent is much more focused on you, the policyholder, The Independent Agent can beat the rates and prices of the big marketing organizations…. they just can’t spend as much getting that message to you. One of the best and easiest ways to look for a good Independent Insurance Agent in your area is to browse on-line, read reviews and see for yourself what the experience of others has been.

CAREFULLY READ POLICY TERMS AND CONDITIONS AND ASK QUESTIONS WHEN YOU NEED THINGS EXPLAINED FURTHER.

It is important to read EVERYTHING including a carrier’s fine print. Carefully check their terms and conditions to make certain that you agree with and understand everything. If there are any errors, including spelling mistakes or misunderstandings bring them to the attention of your Independent Agent. Better yet, schedule an hour each year to sit down with them and review these things together.

- Never rely solely on anyone, other than yourself, to complete and answer questions on an application for you. This should always be done by you yourself with only guidance provided by your agent.

- Never hide material facts about your property, be it past accidents, renovations, etc. it will always come back to bite you in the proverbial behind. Disclose everything.

- Stay away from over valuing or undervaluing your property. One is a waste and the other is a sin.

5 MISTAKES NEW HOMEBUYERS SHOULD AVOID

- Committing to a property before getting a pre-approved loan statement from your lender. So many people go house-hunting and fall in love(with a new house) without knowing what loan amount they qualify for. Just as many homebuyers take on mortgages that make them immediately toxic, which means their eyes wrote a check their wallet could not cash. The first thing a new home shopper should do is find a good banker or mortgage lender. Do this before committing to a property. Find one with excellent credentials, and most importantly, one that has programs that you actually qualify for. Here is another area targeted by slick advertising. Don’t be fooled, do your homework and start local.

- Failing to get good faith estimates. Buyers know they are getting the best financing only once they have received a “good faith estimate” that breaks down the actual loan into all of its component costs and parts. Only then will a buyer have the clearest picture possible of their closing costs. Most important of all, your annual percentage rate, or APR, that should be clearly disclosed in all good faith estimates.

- Being reluctant to negotiate terms. Surprisingly, most new homebuyers fail to negotiate, they are uptight about being confrontational or having disagreements. But negotiations do not have to be hostile. After all, most buyers are negotiating the single most important purchase of their lives. If done professionally and equitably, negotiations most always work in a buyers’ favor, and lenders and builders expect buyers to negotiate. It is all part of the game. By realizing that you hold a power hand, new homebuyers can shrewdly negotiate and get the best new-home deal within their means.

- Failing to ask neighbors about a builder’s reputation. With new construction, before a homebuyer signs on the dotted line, they should speak to a few of their potential neighbors and gather opinions about the builder. Ask important questions such as: Did they have any problems? If so, what were they? How long did it take for the builder to get to the punch list? If the builder was slow to address a problem or has a bad reputation, this is the time to find that out.

- Failing to have a new home inspected by an independent professional is a big mistake. Amazingly, most homebuyers do not even bother to have their potential home inspected if it is new. They mistakenly assume that because it is new and listed for sale that it is done perfectly and ready to go. Make sure to bring in your own inspector and have him/her help you with your final punch list. It only costs, on average, around $300, and is well worth every cent.

How to keep track of your belongings in case of a loss.

Home Inventory Is Important!

What if there is a loss …? What if you have to itemize your personal property after a fire …?

Can you list everything you own from memory …?

The fact is most people own more things than they realize. It’s easy to remember the cars, the computer, the TV. But what about that holiday china in the garage? Or every pair of shoes? Or every bag?

All of it is regarded as personal property for insurance purposes. And if your home is destroyed by fire or some other disaster, having a list of your possessions makes filing a claim easier — and helps you put your life back together.

Why should I complete a home inventory? What’s the best way?

Comparing the value of your belongings to the “contents” limit listed in your policy helps you make sure you have enough insurance to replace them if they are lost, stolen or destroyed as a result of a covered loss. The easiest way to take an inventory is to use a video camera, recording and describing items as you walk through your house. Or, you can use a regular camera and create a home inventory checklist.

Here are a few tips:

- Add brand names and descriptions where you can, especially on large-ticket items. Serial numbers are helpful to note.

- Keep any receipts you have with the list to make the claims process easier.

- Store your video or photo inventory offsite so you won’t lose it if your house is damaged.

- Update your personal property records when you purchase new furnishings and valuables.

- Though the task may seem daunting, it’s important to try. An incomplete inventory is better than nothing at all.

- Use a video camera to record and audibly describe items as you move through your home. If you don’t have access to a video camera, use a standard camera or phone camera.

- Whether you use still photos or video to develop your inventory, include brand names and descriptions where possible, especially on high-cost items.

- Keep any and all receipts on high-dollar purchases. Keep these receipts filed together with any instruction booklets, warranties, etc. that accompany the items.

- Store your video or photo inventory offsite or back it up with an additional drive.

- When you make new purchases, be sure to add them to your inventory.

How much insurance do I need?

We can assist you in analyzing your insurance needs and help you decide how to most effectively protect your personal property.

Finally, remember your homeowner’s policy covers valuable items such as jewelry, furs, art and antiques, only up to set dollar amounts. If the cost of replacing them exceeds these limits, you may want to purchase scheduled personal property coverage.

Backyard safety concerns for your loved ones.

As the weather warms and children start to play outside, homeowners should consider the liability concerns surrounding backyard playground equipment. Seemingly harmless items such as swing sets, slides, swimming pools, diving boards, trampolines or sandboxes can be a source of danger for small children and adults alike, and may open the homeowners to lawsuits and other legal action in the event of injury. Homeowners should seriously consider adding a $1,000,000 or higher Umbrella Liability Policy to their portfolio to increase protection against Liability claims if they have any of these items in their yards. This will minimize their out of pocket financial responsibility in the event of injury or death.

sets, slides, swimming pools, diving boards, trampolines or sandboxes can be a source of danger for small children and adults alike, and may open the homeowners to lawsuits and other legal action in the event of injury. Homeowners should seriously consider adding a $1,000,000 or higher Umbrella Liability Policy to their portfolio to increase protection against Liability claims if they have any of these items in their yards. This will minimize their out of pocket financial responsibility in the event of injury or death.

Slides are a major source of injuries in the backyard. Metal slides are particularly dangerous, as they can easily overheat in the sun and cause severe burns on small children, but plastic slides can still cause injuries. Children may fall over the side or attempt stunts on the slide. This type of equipment can be difficult to secure properly, which creates even more leeway for lawsuits. In especially hot weather, even plastic slides can heat up to unsafe temperatures and cause burns on small children.

Jungle gyms and play sets can also be put together incorrectly if assembled by an amateur, and caution should be used to prevent collapses. Play sets should always be placed on level ground, preferable with a soft, cushioned substrate surrounding the play area. Note that the substrate should always be placed after the play set has been secured and properly anchored to the ground. See manufacturer recommendations for information on anchoring and securing. Temperatures are a consideration for all play set equipment, regardless of the material it is made from. Metal bars get especially hot and can cause burns.

Before digging in your yard to install your playset or swimming pool, ensure you call your utility companies to have lines marked. Failure to do so can result in damage to electric, sewer, internet, cable, and other lines, and can come with heavy fines and extensive damage to structures. It is also advisable to visit your local city hall to determine if any variances are needed to construct play structures in your backyard. If you have a homeowner’s association, they’ll also need to be contacted, as some HOAs have strict rules regarding play structures in yards and require permission, or outright ban their construction. Taking these steps prior to initiating any construction can keep you from paying fees or having to demolish your play structure.

Trampolines are another dangerous backyard toy for small children. All trampolines should have safety netting, and weight limits should be strictly followed. Children should be properly instructed prior to jumping on the trampoline restrict the stunts or any dangerous jumping activities.

Swimming pools carry very specific dangers, regardless of their size. Ensure all pools are enclosed with a tall fence and a locked gate, or are drained or covered nightly with any ladders or equipment stored separately. Individuals who cannot swim should never be near pools without supervision, and home owners should thoroughly check with their homeowners agent or their insurance policy itself to ensure their pool and any liability connected in injury or death is covered adequately. Care should be taken to restrict access to your pool to unauthorized users, as inebriated individuals are among the most likely to fall prey to an injury or fatal accident as a result of access to an unsupervised pool.

All equipment should be inspected frequently for loosened joints, failure of structural integrity, splinters, and other damage resulting from use or weather. Prevention is the best way to ensure injuries are kept to a minimum. In addition to inspection, children should be trained to report any damage they notice or cause while playing to an adult immediately. Equipment should be repainted frequently to reduce damage, wear, and the possibility of splinters. If possible, look to replace wooden structures with plastic, especially in humid areas or places with large wood eating insect populations.

If cooking or burning fires in your backyard, always remove dry debris from the area before lighting the fire. Check that your fire will have adequate ventilation and is not against flammable materials. Use a screen or other means to keep small children and pets away from the fire, as they may not understand verbal warnings about the heat from fires. Always be aware of grease, and have a fire extinguisher available to put out unexpected sparks or fires. Check to ensure your fire extinguisher is properly rated for the type of fire you will be dealing with- grease fires must be put out with a different type of extinguisher than those burning wood or paper.

Homeowners insurance generally comes with some liability coverage for individuals visiting the home, but this coverage may or may not be adequate to protect your assets in the event of a lawsuit or claim. Clients can visit their Massachusetts insurance agent for information on how to document valuables, determine net worth, and calculate how much insurance coverage is needed to limit liability.

Umbrella policies are a great option for those seeking a additional layers of liability protection, especially since homeowners policies are limited on what they will or will not cover.

Why you need an Umbrella Policy for Personal Insurance

Many people make the mistake of believing that their primary insurance policies provide all of the financial protection that they need. In fact, while your homeowners or auto insurance policy are the critical first line of defense, they are only providing basic protection. They do not provide the ultimate level of financial protection that might be necessary.

Many people make the mistake of believing that their primary insurance policies provide all of the financial protection that they need. In fact, while your homeowners or auto insurance policy are the critical first line of defense, they are only providing basic protection. They do not provide the ultimate level of financial protection that might be necessary.

When you need the most comprehensive coverage available to protect you and your family, you would do well to consider an umbrella policy. People who invest in personal umbrella policy’s do so for these important reasons:

Lawsuits

It is very common for accident victims to take legal action in court. If you find yourself the target of a lawsuit, you would be protected against high judgment amounts with an umbrella policy. Judgements in excess of your primary policy limits would not be covered without this essential additional layer of protection.

Asset Protection

Without an umbrella policy, lawsuit plaintiffs awarded a judgment against you can rightfully come after your Home and other assets. Along with having your income garnished, they could also lay claim to your cars, boats, and any other valuable. An umbrella policy keeps those assets intact and protects them from being seized in a lawsuit.

Applicability

Umbrella policies are available to anyone and everyone. While once a resource reserved primarily for business owners and the very wealthy, today these policies are ideal for you as well. Here are a few more reasons you may need this important protection:

- If you have a high-profile or high paying job

- if you own rental properties

- if you own watercraft, or ATVs

- if you have a pool or other recreational activities that occur on your property

- if you own a waterfront home or farm

- if you have teenage drivers in the family

All of these scenarios can cause you to be exposed to litigation in court if an accident occurs in your home, on your property, or during the use of one of your vehicles. The umbrella policy would protect your income and assets and cover the expenses that are left unpaid by your other policies.

Affordability

If you have held off investing in an umbrella policy out of concern for its cost, it’s time to reconsider….these policies are now more affordable than ever. You can purchase a $1 million umbrella for as little as $200 a year. The affordability of these policies make them an option you should not put off any longer for you and your family.

Your basic insurance policies alone may not cover your financial obligations entirely. When you want to protect your family and your assets completely, consider buying a personal umbrella policy.

Make sure your “Plow Guy” is Properly Insured

We live in snow country and chances are you work hard to make sure that your property is safe and protected during those difficult winter months. This includes making sure that you have access to the services of contractors that can do jobs such as managing the snow and ice levels on your property especially on the roof, driveway and sidewalks.

We live in snow country and chances are you work hard to make sure that your property is safe and protected during those difficult winter months. This includes making sure that you have access to the services of contractors that can do jobs such as managing the snow and ice levels on your property especially on the roof, driveway and sidewalks.

How to Choose a Snow Removal Service

You want to make sure that you can rely on your contractor to show up and do the tasks related to snow removal effectively. The contractor should have access to the necessary equipment and tools to do the job right. Additionally, the contractor should have the required business licenses and permits. Insurance is an important component of the contractor’s business credentials. Snow removal services may not be rocket science, but the tasks can potentially damage property and cause harm to occupants and to workers.

Insurance Coverage for Snow Removal Contractors

As a property owner, you maintain liability insurance to protect your assets from law suits in the event of an accident on your property. You should require the same from all contractors who work on your home or building especially those who handle machinery such as snowplows, snow blowers and salt spreaders on your property.

If your snow removal service damages a fence while doing the job, the company’s general liability insurance should repair or replace the damage. If they damage your neighbor’s parked car, your neighbor might rightly be looking to you for reimbursement of those damages. If your contractor is insured you get to stay out of it but if he is not…….then you you will be responsible for your contractors negligence and any ensuing damages. Once your insurance gets involved that may also have a negative impact on your insurance premiums.

Businesses and Homeowners are required to carry workers compensation insurance for employees AND for all those working under their direction or control. This type of insurance provides coverage for employees and those they hire should they suffer harm due to an accident while working for you or on our property. This is mandatory in all states although exceptions are made for small businesses. Without workers’ compensation however, the injured party may look to you for compensation. Even when the law allows a small contractor to waive the purchase of workers compensation for him or herself the Law does not allow you as a property owner or business owner to fail to provide workers compensation for that individual while he is working for you. ALL those working under your direction or control….like our snow removal contractors need to be properly insured. So Always request certificates of insurance from your contractors and read them carefully. Look for the box that declares “Proprietor covered” or “Proprietor NOT covered” under this policy. The Proprietor as well as all his employees ALWAYS needs to be covered while working at your property or business. Once again, claims that do find their way through to your own policy obviously will adversely affect you at renewal time. Make sure your contractors always have their own insurance coverage both General Liability and Workers Compensation.

To protect your property from harm and your assets from being attached to a lawsuit, make sure that the snow removal service you hire has the appropriate insurance coverage.

Trampolines and Swimming Pools Increase your famalies Liability Risk.

Swimming pools and trampolines attract children like flowers attract honeybees. The difference is that children can get hurt on a trampoline and pools with diving board or water slides are especially dangerous. Insurance companies have a name for these kind of things. They call them “attractive nuisances,” and you’re responsible for injuries your guests may suffer when they’re using them. You’re even responsible if someone sneaks in and uses your pool or trampoline without your permission.

If you install a pool or trampoline on your property, your home owner’s insurance carrier must be notified because you are required to report any new risks to your insurance company. If you don’t, you might end up being responsible for claims yourself. Also, some companies do not insure property with this kind of “attractive nuisance” so it’s a good idea to ask your insurance agent before adding a pool or trampoline.

If you do have a pool or trampoline, there are a few things that you can do to mitigate the problem and show your insurance company that you’re trying to prevent injuries. If you follow these safety precautions, your insurance provider might not raise your rates:

Pools:

- Install a fence or wall with a self-closing, self-latching gate to prevent unauthorized use. The gate should open out from the pool. To keep children from opening the gate, there can be no openings larger than one-half inch within 18 inches of the latch.

- Set up an alarm to alert you if any unsupervised people enter the area. Be certain that the alarm is loud enough to be heard over your stereo system or television.

- A safety cover over your pool is easy to open and close and can prevent accidental falls into the pool.

Trampolines:

- Teach your children about trampoline safety. Explain that they could get hurt if they use it improperly.

- Supervise who is using the trampoline, especially if they are inexperienced.

- Children under the age of 6 should not be allowed to use your trampoline.

- Put an enclosure around the trampoline so children can’t fall off.

Don’t take a chance. Make your pool or trampoline as safe as possible.

Are the Solar Panels on my roof covered by Home Insurance?

Solar panels can eliminate your electric bill and prevent various types of pollution. However, this technology still requires a substantial investment. A typical residential system costs about $15,000, according to the Boston Globe. It’s vital to protect this valuable property by confirming that your home insurance covers it.

Solar panels can eliminate your electric bill and prevent various types of pollution. However, this technology still requires a substantial investment. A typical residential system costs about $15,000, according to the Boston Globe. It’s vital to protect this valuable property by confirming that your home insurance covers it.

Standard Policy

You should notify your Insurance Agent about the change immediately. As long as the panels don’t cause your home’s replacement value to increase beyond your coverage limits, most insurers will automatically cover roof-mounted photovoltaic equipment at no additional cost.

Leakage Concerns

Installers use a variety of techniques to equip homes with photovoltaic panels. Some contractors install mounts and wiring that penetrate the roof. This can increase the likelihood of ceiling leaks and damage. As a result, it is very important that you obtain a certificate of insurance from the installation contractor. This way any claims for water damage can be put under the contractor’s insurance and so they do not affect your own Home Insurance rating.

Panel Location

To maximize sun exposure, some homeowners install their solar panels on poles or place them on the ground. If this installation best suites your individual needs then it becomes especially important to speak with your Insurance Agent. It may be necessary to purchase additional coverage to increase the limit available for detached applications such as these.

Reimbursement

Depending on the scope of your project it may be necessary to increase your coverage limit. The limit needs to reflect the total replacement value of your house, including the photovoltaic panels thus ensuring you’ll receive full compensation if the panels are damaged or destroyed by a covered loss.

Types of Damage

Standard home insurance covers several kinds of solar panel damage. Generally, it will reimburse you when severe weather, fire or vandals harm your equipment. You will also receive compensation if someone steals the panels.

Extra Coverage

If you’re worried about other natural disasters, talk to your agent about purchasing flood or earthquake insurance. Be sure to confirm that your specific company is willing to cover photovoltaic systems. Basic home insurance policies often include hail, thunderstorm and tornado coverage as well.

Documentation

An insurer is more likely to approve solar panel claims quickly the more documentation you can provide about the system. Documentation becomes very important when a disaster occurs. Remember to keep original receipts and photos in a safe place. For extra protection, you can always give copies of them to your insurance agent for safe keeping.

Dog breeds that could raise your insurance rates.

Your dog might be your best friend, but chances are it is not best friends with everybody who visits your home. People adopt dogs for many reasons, including companionship, protection and breeding. Some dogs are put to work at an early age guarding livestock or being watchdogs, but most dogs earn their living loving us as much as we love them.

All homeowners are aware that they have to carry insurance to protect themselves in case someone gets injured on their property by an overprotective dog. But the truth is that certain dog breeds have a bad reputation for being too aggressive.

If you’re planning to adopt a dog, you should consider how your new pet could affect your insurance rates. Some breeds can raise your rate, and other breeds could cause your insurance company to cancel your policy. Your dog may be the sweetest little buddy you’ve ever had, but these dog breeds, in particular, are noted for attacking people and other dogs. You might want to rethink adopting a pooch from this list.

• American Pit Bulls and Staffordshire Terriers share a similar appearance and the ability to cause serious harm. They can be sweet and affectionate one minute and vicious the next. Their size and jaw strength have put them front and center among dogs that injure and kill. They’re even notorious for attacking their owners. They were responsible for over 60 percent of the 38 fatal dog attacks in the U.S. during 2012.

• Dobermans used to be extremely popular, but after a rash of attacks in the 1970s, many people have shied away from the breed. They tend to be very protective and aggressive, which makes insurance companies fear the worst.

• Rottweiler’s aren’t as tall as Dobermans, but they are stockier, and their jaws generate over 300 pounds of pressure per inch. They can quickly and easily break a person’s arm or seriously injure or kill a child.

• Chows have earned a reputation among vets as being unpredictable. That unpredictability makes them a very dangerous breed to own, especially around children.

• German Shepherds make great police dogs and pets. However, they are territorial and protective. If unfamiliar relatives, friends or strangers come calling, they might be met by a not-so-welcoming host.

Almost any dog can be provoked, but the ones on this list are notorious. Keep that in mind when you’re choosing a new pet to join your family.

Spring flood season preventative measures

When you think about flooding, you may imagine storm surge from a hurricane, or a dam bursting or even a river overflowing its banks. If your home or business is located far from these hazards, it’s easy to feel safe. Unfortunately, feeling safe and being safe are two different things.

According to the National Flood Insurance Program, almost 20 percent of flood insurance claims come from areas that are at low to moderate risk of flooding. Even properties far from bodies of water can suffer damage.

How do floods happen?

Flooding can come from a river or stream, or it can come from sources you might not think of, such as:

- Ice jams

- Midwinter snow melt

- New development that changes water runoff patterns

- Heavy rains

- Spring thaw

- Flash floods

What is a flood?

A flood is defined as a temporary inundation of two or more normally dry properties from certain natural sources, including:

- An overflow of waters from a tidal area or inland source, such as a river or stream.

- Surface water from any source that accumulates rapidly, such as storm runoff or snow melt.

- Mudflows, where a river of mud is carried along by the force of water.

- When erosion or undermining from wave action causes land on the shore of a lake or other body of water to collapse or subside.

When these things happen, they can cause a great deal of damage very quickly. Even a few inches of water in a basement can ruin furnaces and water heaters. Water seeping into living spaces destroys flooring and damages walls.

Most property insurance policies won’t cover repairs. Federal disaster funds often come in the form of a loan that must be repaid — with interest. Flood insurance claims average almost $4 billion per year. The NFIP has paid over $48 billion in claims since 1978.

About flood insurance

The National Flood Insurance Program was created to provide coverage to property owners regardless of their risk. The rates are the same across the country. Policies are purchased from private insurance agents, and administered by the NFIP. In low risk areas, the premium can be as little as $129 per year. Flood insurance may be required in order to get a mortgage.

When to get flood insurance

If you don’t already have flood insurance, the time to get it is now. There is a 30 day waiting period before coverage goes into effect. Flooding can happen any time of the year, even during the cold weather. It’s better to have the policy in place before the water rises.

How to protect your above ground pool from collapse due to the weight of ice and snow (which is not covered under the Homeowners Policy).

Particularly snowy winters can wreak havoc on above ground pools, which are designed to withstand the weight of water in the summer but are more vulnerable to the pressure of heavy snow and ice in the winter. Also, melting snow in the spring can turn to ice and expand, potentially damaging the pool, especially the cover.

It’s therefore essential to keep a close eye on your above ground pool and regularly clear the snow off its cover so it’s never entirely buried under the snow.

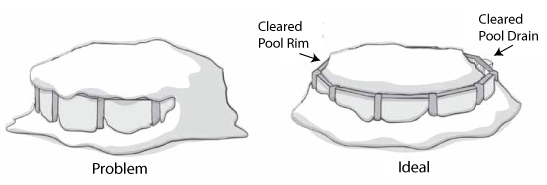

IS YOUR POOL BURIED?

It’s important to clear off your pool before it collapses under the weight of snow. The following tips will spare your pool a lot of punishment and allow it to make it to spring in one piece!

- Stay outside the pool when removing snow. If you try to work from inside the pool, the snow or ice could give way under your weight. This may damage the pool cover—and result in you being injured.

- Careful with the pool rim. Use a plastic shovel so as not to scratch the edges of the pool. Also avoid walking on the coping to clear snow from the rim of the pool as this could weaken or crush the pool structure.

- Don’t forget the skimmer drain. You should remove snow from inside and on top of the drain to keep it from cracking.

- Hire a professional, if you need to. By calling on a pool professional, you’ll be sure the work is done right and safely—both for your sake and your pool!